We understand complex tax challenges

At Azets, we offer specialised tax advice tailored to medium-sized and large companies. Our expertise includes a wide range of tax-related services to ensure your business navigates the tax landscape safely and efficiently.

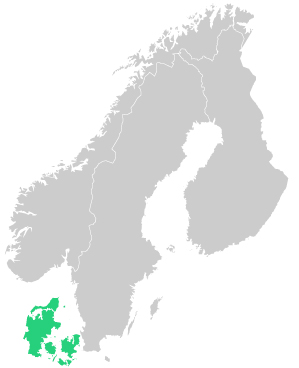

Tax rules are constantly changing and it can be a challenge to keep up. Our goal is to provide the advice that ensures your company not only complies with applicable Danish laws and regulations, but also continuously optimises tax and financial reporting workflows.

We offer tax advice on

- International tax law: If the company does business internationally

- Transfer pricing-documentation: So that documentation is prepared correctly and in accordance with legislation

- M&A (Mergers and Acquisitions): Tax consequences of mergers, acquisitions and other forms of business combinations

- Corporate tax planning: Strategic planning to minimise the company's tax burden while complying with applicable tax laws

- Indirect taxes: Advice on VAT, customs and other indirect taxes

- Property taxation: Advising on the tax aspects of property investments and transactions.

- Payroll and employee taxes: Advice on tax and social security aspects of employment relationships, including employee secondment

- Reporting and Compliance: Help with ensuring that your organisation complies with local and international tax reporting requirements.

- Annual report and tax return for companies: Advice on the tax aspects of year-end closing and preparation of annual reports and tax returns for companies

- Reporting of employee shares in E-kapital: Guidance on the proper reporting and tax treatment of employee shares or share-based compensation schemes. This includes understanding the taxation rules for employee shares, as well as the technical requirements for reporting in the E-kapital system.

Our tax advisers have extensive experience and in-depth knowledge of Danish tax law and practice, ensuring you get the best guidance

Tax advice in connection with annual reports and tax returns for companies

An efficient year-end closing process is critical to the financial health and regulatory compliance of any organisation. Azets offers assistance and advice in this process so that your organisation not only complies with all relevant regulatory requirements, but also produces clear and accurate financial reports.

Our experts help you navigate the complex accounting standards and Danish tax rules that affect your annual report and tax return. We offer, among other things:

- Detailed review and preparation of the annual report and tax return for the company

- Strategic advice to maximise performance and tax efficiency

- Support and guidance on complex accounting issues

Advice on the preparation of transfer pricing documentation

In a globalised economy, transfer pricing has become a key focus area for many companies. Proper preparation of transfer pricing documentation is essential to ensure compliance with international tax laws and avoid costly disputes.

Azets offers specialised advice and support in the preparation of transfer pricing documentation.

Our team of transfer pricing experts will work closely with your organisation to develop and implement a strategy and process for your transfer pricing documentation that not only complies with legislation, but also supports your business strategy and goals.

Azets’ tax advisory services ensure that your organisation navigates the complexities of Danish legislation efficiently and safely, while optimising your tax and reporting processes and workflows.

Want more information?

You are always welcome to give us a call. If you want us to contact you, fill in the form and we will contact you as soon as possible.

+45 70 232 232