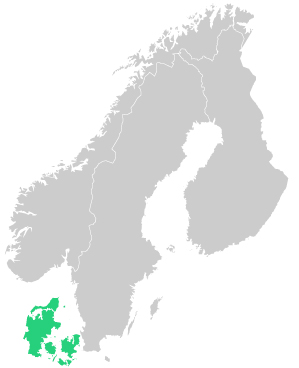

Sweden has introduced new rules on the taxation of labour hire with effect from 1 January 2021. The new rules mean that, from the turn of the year, foreign employees must be taxed in Sweden when they perform temporary work in the country – even if their employer is Danish. In this article we present an overview of the impact the new Swedish rules will have on you as an employer.

What does the legislative change entail?

On 4 November 2020, the Swedish Riksdag adopted new rules for the taxation of foreign workers in Sweden. Under previous Swedish rules, it was only possible to tax a foreign person who has taken up temporary work in Sweden on behalf of a foreign employer when the employee has resided in Sweden for more than 183 days within a period of 12 months.

The new rules, which came into force on 1 January 2021, has thus replaced the 183-day rule and expanded tax access. This means that, as an employer, you must take into account that your employees may become taxable in Sweden from their very first working day.

Foreign employers must be registered in Sweden

In addition to Swedish taxation, the new rules also mean that as a Danish employer, you must register your company in Sweden, submit employer declarations, etc. In addition, as a foreign employer, you must also withhold and report Swedish salary tax for the work your company performs in Sweden.

No rules without an exception

However, there is a single exception to the rules. In Sweden, a minimum limit has been set for the number of working days before labour must be taxed. This means that a Danish employee can work in Sweden for a continuous period of no more than 15 days before the taxation takes effect – IF the total number of working days in Sweden does not exceed 45 days in the full calendar year. It is therefore essential that as an employer, you create a system that can handle and keep track of your employees' working days in Sweden.

Need guidance?

If you have questions about the new rules or general questions about taxation, you are welcome to contact us so that we can discuss your challenges and opportunities.