When we talk about bonuses, we refer to an extraordinary amount, which is deposited in the employee's account. A cash bonus may be given either after an goal has been achieved – that is, when one or more conditions are met. And a bonus can be given as a cash amount, which will be transferred to employees on a given date.

The terms of the bonus hold significance

In most cases, a requirement for the bonus has been agreed in writing. This may be for example:

- that the employee, department or entire company must obtain a specific revenue in a given period

- that the number of customer inquiries has increased

- or any other parameter.

Once the condition is met, it triggers a bonus. The bonus can be agreed as a fixed amount or as a percentage of a given amount (often revenue or profits).

When must a bonus be taxed?

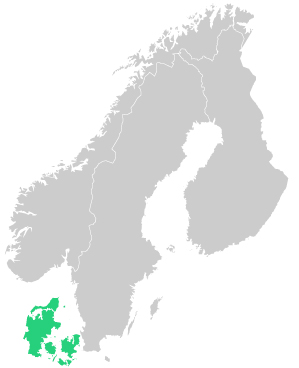

A bonus must be taxed under the applicable rules of the Danish Act on Taxation at Source (income tax and labour market contributions). But when, exactly, should taxation take place?

Here, tax law distinguishes between whether the terms of the bonus are formalities, or whether there is real uncertainty as to when and whether the terms are met.

In the first case, in a hypothetical example we may consider a company, which has as a condition that the employee is employed on the bonus payment date.

Formality or uncertainty

In the case of a condition, which in nature is a mere formality, the bonus is taxed as soon as the agreement regarding the bonus is entered into.

If, however, there is real uncertainty as to whether the condition can be met, taxation will only take place when all conditions are met. That is, when the sales target or the like has been reached.