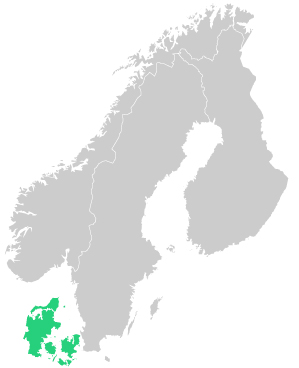

Relief packages related to COVID-19 in Denmark

|

Action |

Who is it relevant for? |

How can Azets assist? |

|

Postpone payment of AM-contribution and A-tax (valid for large companies): - Due date for April 2020 (April 30th) is postponed until August 31st 2020 - Due date for May 2020 (May 29th) is postponed until September 30th 2020 - Due date for June 2020 (June 30th) is postponed until October 30th 2020 |

Companies with yearly AM-contribution above DKK 250.000 or/and A-tax above DKK 1.000.000. |

Azets can assist in:

|

|

Postpone payment of AM-contribution and A-tax (valid for small and medium-sized companies): - Due date for April 2020 (May 11th) is postponed until September 10th 2020 - Due date for May 2020 (June 10th) is postponed until October 12th 2020 - Due date for June 2020 (July 10th) is postponed until November 10th 2020 |

Companies with yearly AM-contribution below DKK 250.000 or/and A-tax above DKK 1.000.000. |

Azets can assist in:

|

|

Postpone payment of B-tax: Payment of B-tax for April and May 2020 is postponed until June 22nd 2020 and December 21st 2020 respectively |

Sole proprietorships |

Azets can assist in:

|

|

Temporary compensation scheme for self employed and personal owned companies Total compensation is 90% of expected revenue loss in the aid period compared to average revenue in the latest financial year. Compensation is a maximum of DKK 23.000 monthly (for each CPR, for more than one owner). If a self-employed person also employs a spouse, the compensation maximum is increased by 100% to DKK 46.000. Compensation is taxable income. This financial relief package is valid from March 9th until July 8th 2020. Business owners can be included in the scheme a maximum of 3 months. The business can not receive compensation for the same cost from more than one aid scheme relating to COVID-19. |

Companies that expect revenue loss of a minimum of 30% due to COVID-19. In addition companies must have had an average monthly revenue of minimum DKK 10.000 in a previous period. This aid scheme is reserved for business owners that hold a minimum of 25% ownership and work in the company. The business owner and the company must be registered in CVR- and CPR registers to be eligible for aid. The company shall be registered on February 1st 2020 at the latest. The company can have a maximum of 25 full time employees. |

Azets can assist in:

|

|

Temporary compensation scheme for freelancers etc. The person self-employed can receive a compensation of 90% of expected loss of B-income. Maximum compensation amount is DKK 23.000 monthly based upon signing a solemn declaration declaring expected loss of income of at least 30% as a consequence of COVID-19 from March 9th until July 8th 2020. |

Self-employed without CVR-number The aid scheme covers self-employed persons with a B-income of a minimum of DKK 120.000 during 2019 - equaling DKK 10.000 monthly on average. |

Azets kan hjælpe dig med:

|

|

Temporary compensation for companies fixed costs - 80% compensation for companies with drop in revenue of 80-100% - 50% compensation for companies with drop in revenue of 60-80% - 25% compensation for companies with drop in revenue of 35-60% Calculate your compensation here |

Companies that experience drop in revenue over 35% due to COVID-19 from March 9th until June 8th |

Azets can assist in:

|

|

Postpone payment of VAT Payment of VAT-period for March, April and May 2020 is postponed by 30 days. This means: - Due date April 27th 2020 is postponed until May 25th 2020 - Due date May 25th 2020 is postponed until June 25th 2020 - Due date June 25th is postponed until July 27th 2020 |

Companies liable for monthly VAT Yearly revenue above DKK 50.000.000 |

Azets can assist in:

|

|

Postpone payment of VAT 1st and 2nd quarter 2020 are combined. This means that the declaration and due date for 2nd quarter 2020 will be September 1st 2020 |

Companies liable for quarterly VAT Yearly revenue between DKK 5.000.000 - 50.000.000 |

Azets can assist in:

|

|

Postpone payment of VAT The 1st and 2nd half of 2020 are combined. This means that the declaration and due date for 2nd half 2020 will be March 1st 2021. |

Companies liable for biannual VAT |

Azets can assist in:

|

|

Guarantee scheme Implementation of state warranted guarantee of 70% on bank loans issued to otherwise financially healthy companies |

Companies that have experienced or expect a drop in revenue above 30% relating to COVID-19 |

Azets can assist in:

|

|

Sending employees home to avoid redundancy It is possible to temporarily send employees home for a period of maximum 3 months. To be eligible for this aid package the company must send a minimum of 30% or 50 people home and the staff should receive a full salary while at home. The company will receive a salary compensation of 75-90% (max. DKK 30.000) for each employee sent home. Each included employee will contribute to the compensation package by spending 5 holidays in the period. |

Companies that due to lack of production activities caused by COVID-19 would otherwise dismiss at least 30% of employees or more than 50 employees. |

Azets can assist in:

|

|

Sickness benefits reimbursements Reimbursement from first day of absence due to sickness with COVID-19 |

All companies |

Azets can assist in:

|

|

Compensation for cost relating to postponed or cancelled events, that was otherwise planned to be held between March 6th 2020 and March 31st 2020 and was open for registration prior to March 6th 2020. The event shall be for more than 1.000 attendees (or 500 attendees for events intended for attendees in special risk groups). Liable for compensation is only costs that is not otherwise compensated through other relief packages, insurance etc. No compensation for loss of earnings is possible |

All companies |

Azets can assist in:

|

General possibilities, you should consider

|

What can you do? |

Who is it relevant for? |

How can Azets help? |

|

Use of current cash position |

All companies |

Azets can assist in providing overview. |

|

Debt collection |

All companies |

Azets can assist in providing overview. |

|

Establish overdraft facility with the bank. Is especially useful after the public credits and relief facilities expire. |

All companies |

Azets can assist in providing necessary documentation for the bank. |

|

Cost reductions |

All companies |

Azets can assist in providing overview. |

|

Ordinary tax on account reduced to 0. Deadline 1 rate: 20 March |

Public and private limited companies |

Azets can assist in changing the tax on account on skat.dk Deadline 1 rate: 20 March |

|

Overview/cash flow budget. A very important tool in order to navigate safely through the coming period is to have an updated overview of finances and cash flow. |

All companies |

Azets can assist in preparing both financial budgets and cash flow budgets that will allow for temporary drop in activities and will include effects from chosen financial relief packages. |