Azets' Newsletter for Payroll and HR, Q3 - 2015

This newsletter presents the recent changes, deadlines and information regarding payroll and HR matters from Q3 – 2015 of interest to small entrepreneurs and up to large international groups. If you have questions we are always ready for a consultation free of charge.

Fast-track scheme: New rules for work and residency permits

Things have gotten easier for several Danish companies

Life got a little easier on April 1, 2015 for companies that wish to hire employees from third countries (non-EU countries). Prior to this, lengthy processes related to obtaining work and residence permits meant that an employee from abroad could only commence work long after he or she had been hired in Denmark.

The fast-track scheme

A new so-called fast-track scheme has recently been introduced, which enables a quick and flexible job start for foreign workers. Foreign employees can now commence their employment in Denmark immediately after submitting an application for a work and residence permit.

Besides the rapid job start, the fast-track scheme also allows foreign employees to work alternately in Denmark and abroad without the current rules on termination of residence permits upon exit from Denmark being applicable.

The new fast-track scheme applies to both private companies and public bodies.

Which companies are covered by the fast-track scheme

The fast-track scheme can only be used by companies that are certified.

To achieve certification the following conditions must be in place:

- Salary and employment conditions must correspond to Danish norms. If the company is not covered by a collective wage agreement, it must declare that it meets this requirement.

- There must be a minimum of 20 FTEs in the Danish company.

- The organisation may not be engaged in a legal labour dispute.

- The organisation may not at the time prior to the certification have serious unresolved issues with the Labour Inspectorate (for instance the 'red smiley').

- The organisation may not within the past two years have been found guilty of repeated violations of the Aliens (Consolidated) Act or fined at least DKK 20,000 as a consequence of the violating the Act.

- The company must have participated in a briefing session at the Danish Agency for Labour Market and Recruitment.

Applying for certification

Applying for certification under the fast-track scheme must be done digitally. A fee must be paid along with the application. A certification is valid for 4 years, but can be revoked if the conditions for the certification are no longer present.

Company cars and holiday use abroad can reduce the tax value of a free car

When an employee has been given a company car, the employer is generally expected to cover all costs related to the car - including fuel expenses. A number of employers, however, have a clause specifying that the employee is responsible for fuel and other related expenses if the company car is to be used on vacations abroad.

In such cases, the expenses may in some instances reduce the taxable value of a company car. However, it is a condition that the employee returns original copies of the receipts to the employer, who must enter those receipts as business expenses while also entering a corresponding amount in the company accounts as a user charge for the company car.

Annual leave - how does that work?

The holiday season is coming up, and each year the same questions pop up:

- How is unspent annual leave transferred?

- How much annual leave can be transferred, and what are the formal rules?

- What if an employee becomes ill before his or her holiday or during it?

- What about additional holidays?

We will give you a quick overview of the rules. Read more below.

'Accrual'-year and the 'holiday'-year

'Accrual'-year and the 'holiday'-year

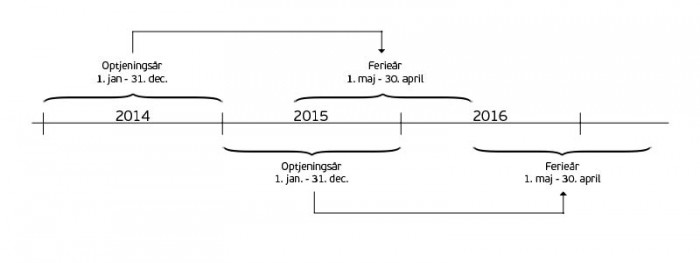

The right to paid leave accrues during the calendar year from 1 January to 31 December (which we will refer to as the 'accrual year")

Paid leave is taken during the holiday year which runs from 1 May to 30 April in the year after the accrual year.

The figure below shows how the two years are linked.

Every employee earns the right to paid leave which amounts to 2.08 days per month of employment during the accrual year. If a person is employed for a full year, he or she has earned 25 days of paid leave.

The rules are set out in the Danish Holiday Act, and are based on the premise of a five-day working week. It does not matter whether the employee is working full time or part-time for the company. Part-time workers also have the right to 25 days of paid leave if they have worked throughout the entire accrual year.

How do you transfer unspent annual leave?

How do you transfer unspent annual leave?

If the employee has not had time to spend their entire holiday entitlement before the end of the holiday year, expiring on 30 April, any annual leave beyond 20 days can be transferred into the next holiday year. Taking more than 20 days of paid leave is often referred to as the "fifth holiday week". Please note however that special rules may apply if the employment is covered by a collective agreement.

The agreement on the transfer of unspent holiday entitlement takes place between the employee and employer and should for legal reasons always be put in writing. The agreement must be concluded before 30 September after the end of the holiday year.

If an agreement has been made on the transfer of unspent days, the employer must notify the Danish Labour Market Holiday Fund or the relevant holiday card scheme administrator. Failure to do so will result in the Holiday Fund/administrator classifying the annual leave transfer as unclaimed. In some cases, the failure to notify the appropriate authority can mean that the company itself is liable for compensating the employee for the 'lost' holiday entitlement.

Illness before and during annual leave

The employee's paid leave begins on the first day of leave when working hours begin.

Illness before annual leave

If the employee becomes ill before the first day of leave commences, such an event is referred to as an annual leave obstacle, and the employee consequently has no obligation to take his/her holiday entitlement. If the employee does not wish to take his/her leave due to illness, the employee has to formally notify their employer that their illness has become an obstacle to taking their annual leave.

From the 2012/2013 holiday year and onwards, employees have been entitled to so-called 'compensatory leave' if they have not been able to take their leave due to illness.

If the employee recovers before their originally planned annual leave ends, they must report themselves as healthy and notify their employer if they wish to go back to work or take the remainder of their originally planned leave.

Illness during holiday

Illness during holiday

If an employee becomes ill after the leave has begun, the employee is entitled to compensatory leave after the first five sick days.

If the employee has more than one period of leave with illness within a holiday year, the employee is entitled to compensatory leave after five sick days counted over the total holiday year. Accordingly, if the employee has had five sick days during their first holiday in a holiday year, the employee would generally be entitled to compensation from the first reported sick day if he or she falls ill during another one of their holidays in the same holiday year.

It is, however, contingent on the employee having accrued the full 25 days of paid leave. If the employee has accrued fewer than 25 days of leave, he or she accordingly is entitled to fewer days of compensatory leave. This means that the right to compensatory leave commences relatively sooner. The number of days that the employee does not get compensatory leave for is calculated by multiplying the number of accrued days of leave by 1/5.

Say, for instance, that an employee has earned the right to 20 days of leave. The number of sick days that the employee does not get compensatory leave for is 20 x 1/5 = 4 days.

The rules on compensatory leave are contingent on the employee obtaining a doctor's note confirming that he or she has been ill.

Additional holidays

Many people believe that additional holidays are extra leave covered by the Holiday Act, but that is not the case. The right to additional holidays can either be the result of a collective agreement, specified in an employee handbook or individually agreed with the employee.

As the Holiday Act does not regulate the additional holiday and because the Holiday Fund cannot process contributions for more than 25 days of annual leave, it is important that the employer establishes clear guidelines on how the additional holidays are handled.

Azets therefore recommends that you, as the employer, should consider the following points:

- How are the additional holidays accrued (from the employee's first day of work, by the calendar year, or the holiday year)?

- How should the additional holiday be spent (should they be spent before/after the holidays covered by the Holiday Act)?

- How to handle unspent additional holidays (transfer to next year, lapse or salary compensation)?

- How will you administer and monitor additional holidays?

Company cars and speeding tickets - new rules

On February 1, 2015 the Danish Road Traffic Act was changed. The new rules state that the owner of a car has direct liability for payment of fines for speeding in that car, even if someone else was driving it at the time. This has an impact on employers who make their company cars available to employees.

With the new rules, the employer is directly responsible for paying the employee´s speeding tickets when the employee is driving a company car - even when he or she is not driving on company business.

The employer/owner of the car, however, can only be forced to pay fines for speeding infractions up to 30 % above the permitted speed. The employee is personally liable for any additional sanctions.

If the employee acknowledges to have been driving the car at that time however, the employer/owner is not responsible. If the employee does not acknowledge that he or she was driving the car, the owner/company cannot claim deductions for the expenses, as it is neither an operating expense nor an employee expense.

We recommend that you as an employer adapt your employee manuals or perhaps prepare a supplement to the relevant employee's contract to clarify the organisation's position on the new rules laid out in the Danish Road Traffic Act. Azets´ HR Legal team can provide further advice on this.

Working across Oresund

When the Øresund Bridge opened on 1 July 2000, an abundance of opportunities opened with it. However, not many people had predicted the challenges that followed in relation to taxation when you live in one country and work in another.

The rules on working across Oresund have been changed and fine-tuned a number of times. Having said that, they have not become easier to figure out. Here is a quick overview of the taxation rules and deduction possibilities.

Taxation when you live in Sweden and work in Denmark

Taxation when you live in Sweden and work in Denmark

It is actually not that difficult if you just remember the main rule - you will be taxed in the country where you work. If you live in Sweden and commute every day to your job in Denmark, you will pay Danish tax. You do not pay Swedish tax on the salary you earn in Denmark.

The challenge occurs if you do not work 100 % in Denmark.

Denmark and Sweden have entered into a special agreement, which takes into consideration the terms of employment in which working from home in Sweden is included or where work is done periodically in the country of residence, i.e. Sweden. The rule is that if you work more than 50 % of the working hours in Denmark, the salary from your Danish employer can still only be taxed in Denmark. This is measured over every three-month period.

Which taxation method should be chosen?

When you live in Sweden and are taxed in Denmark, you can choose between two forms of taxation:

- Taxation as a limited liability to pay tax

- Taxation according to the frontier worker regulations

In brief, you will always be able to be taxed according to the rules for limited liability to pay tax.

If you earn more than 75 % of your total annual income from Denmark, you can choose to be taxed according to the frontier worker regulations, which give you more deduction options.

Finally, you must be aware that even though you live in Sweden, you can have the possibility of using the 26 % taxation scheme (expert taxation scheme) if your monthly salary package is at least DKK 61,500 and also if you fulfil the other requirements.The good exit interview

What is an exit interview and what can the company use it for?

An exit interview is used when an employee resigns from his or her position. It is used by the employer to get feedback on the employee's experiences in the company for future use. The interview is used by the resigning employee to pass on information and to get closure on the employment. Having an exit interview is not a requirement and, therefore, the resigning employee should be invited to a voluntary interview.

Most often, the interview is held when the employee has given notice and this does not need to be because of dissatisfaction with management or the company. Perhaps the employee is moving far away from the workplace, perhaps illness or age are the reasons. However, if the employee has been dissatisfied, this will be disclosed without risk for the resigning employee and will contribute to current employees not having to face the same challenge. The employee will pass on experiences and knowledge or provide ideas for improvement. It is important that the representative for the company listens actively and makes a note of advice, criticism and improvement suggestions.

Before the interview:

The company invites the employee in good time before the last day of work for a voluntary interview, either with the immediate superior, with HR or another person requested by the employee. If the employee leaves the company due to dissatisfaction with the immediate superior, it can be problematic to hold the resignation interview with this person. It is important that the employee feels that he/she can speak freely. Both parties prepare for the interview possibly by using these tips:

During the interview:

The interview itself should take place without interruption and should be an equal dialogue where the employee tells about his/her positive and negative experiences and where the other party can ask about the employee's assignments. In this way, the company gains an idea of what needs to be focused on after the resignation.

Here are a couple of examples to begin the interview with:

- Which tasks are you working on?

- What is and has been the common thread throughout your job and your tasks?

- How had you planned to continue to work on the tasks if you had remained in your job?

- What difference will it make to the workplace that you are resigning from your job?

Avoid routine

It is important that the employee does not feel that the interview is being conducted as a routine. The employee must feel that there is a genuine interest in the employee's message. The employee is not obliged to give information, so the interview should be kept on a professional level. If unexpected and important information is given, this can be checked after the interview. If it proves that the actual tasks or workload differentiates from the job description, this information can be of great value when the position is to be filled again.

For the resignation interview to be really good, it is important that the employee also receives useful information. For example, the following could be reviewed with the employee:

- Your salary will be paid by the company for x months

- Remember that payment of your holiday pay is not included in your advance tax assessment

- How many holiday days are paid via Feriekonto or in cash if you hold your holiday directly after your exit

- The Danish Marketing Practices Act

- Any clauses

Finally, the employee and the other party will talk about which initiatives could possibly be taken in the future and whether information should be communicated to the rest of the workplace. The company is responsible for this communication. The exit interview should finish when the employee has given the information that he or she can or will give and when the manager/HR has answered the employee's questions. There is no reason to drag out the interview.