Do you own one or more companies dealing with e-commerce across the EU? Then you must be aware that, as a result of the new VAT rules, you will be obliged to sell your goods with foreign VAT in the future.

Businesses selling to private individuals in the EU can take advantage of tools that can make administration of the new scheme easier.

The new e-commerce package consists of:

- One common and complete distance selling limit of EUR 10,000 within the EU.

- VAT One-Stop Shop.

- VAT exemption for small shipments under DKK 80 from third countries lapsing.

- New rules for e-commerce platforms.

VAT One-Stop Shop

The new VAT One-Stop Shop scheme came into force on 1 July 2021 and means that you can now gather your EU VAT accounts in one place. VAT One-Stop Shop is a voluntary scheme that makes it easy to comply with the new VAT rules and report and pay VAT on sales to private individuals in the EU, as VAT must be paid in the country of consumption – i.e. the country where the product or service is used.

The new One-Stop Shop consists of three schemes:

- EU scheme (for EU companies)

- Non-EU scheme (for companies outside the EU)

- Import scheme

All companies have the opportunity to sign up for one or more schemes. However, registration depends on where the company is established and what it sells.

Registration for VAT One-Stop Shop is valid from the first day of the calendar quarter after the registration has been submitted in the system. If the company is registered for the Import Scheme, the registration applies from the first day of the calendar month after the registration has been confirmed by The Danish Customs and Tax Administration.

If your company was registered in the previous One-Stop VAT scheme, it was automatically transferred to the new VAT One-Stop Shop scheme on 1 July 2021. But before that happened, you should have submitted the following information to the Danish Tax Agency:

- Business locations and warehouses in Denmark and the rest of the EU.

- VAT or tax numbers associated with places of business and inventory.

- Past and present registrations.

- VAT numbers issued by another member state.

- Whether the company is a platform company under the EU scheme.

EU scheme (for EU companies)

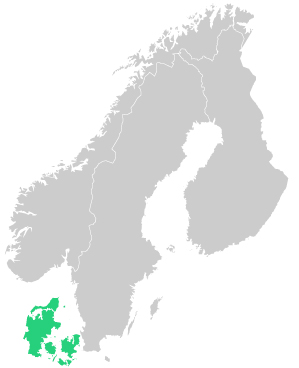

The EU scheme applies to companies located in Denmark or in another EU country.

The EU scheme covers the distance selling of goods and the sale of certain services to consumers in other EU countries, where VAT is payable in the country of consumption.

This means that companies can report VAT via their own home country instead of having to be registered in individual countries. The scheme also applies to companies registered in the EU but headquartered outside the EU if they carry out distance selling of goods within the EU.

Non-EU scheme (for companies outside the EU)

The non-EU scheme applies to companies whose economic activity is headquartered outside the EU (a so-called third country) and which have no permanent establishment in the EU.

The non-EU scheme covers services where VAT is payable in the country of consumption. This means that companies outside the EU do not have to register in the countries in the EU where they sell services to private individuals but can choose one country from which they can submit accounts to the rest of the EU.

The import scheme

The import scheme, also called the Import One-Stop Shop, is a new scheme for companies that offer distance sales of goods imported from outside the EU to private consumers within the EU in consignments with a real value not exceeding an amount of 150 euros. Distance selling is the sale of goods by a company which are then sent to a private consumer across a national border, where the seller participates in the transport. This usually applies to sales via the Internet.

The import scheme has been established because the VAT exemption for goods under DKK 80 from countries outside the EU has been abolished. If the company is registered outside the EU and wants to use the scheme, the company must be registered through an intermediary, and the intermediary must be registered in an EU country.

Sales of goods subject to certain excise duties (e.g alcohol and processed tobacco) may not be covered by the Import Scheme. If the company sells goods in consignments with a real value exceeding 150 euros from a country outside the EU to private consumers within the EU, the company cannot use the Import Scheme either.

Platform business (sales via portals, etc.)

A platform company is a company that, with the help of an electronic interface such as a marketplace, platform, portal or similar, mediates distance selling of goods to private consumers in the EU. Examples are companies like Google, Amazon or Facebook.

The platform is regarded as the company that sold the goods, which is why the platform is what can be registered in the VAT One-Stop Shop scheme, and not the company that sells through the platform.

The goods sold to private consumers can come directly from a country outside the EU. The platform can be registered and thus settle VAT via the Import Scheme. This applies regardless of where the companies that sell goods via the platform are based, as long as the goods come from a country outside the EU. The import scheme can be applied only when the goods have a value not exceeding 150 euros.

If the goods come from a warehouse in the EU and are delivered to private consumers in the EU, either as distance selling or domestic sales, and the company that sells the goods via the platform is not established in the EU, the platform can be registered and settle VAT via the EU scheme. In this case, the limit of 150 euros does not apply.

However, the EU scheme does not apply to the platform's domestic sales of own goods. It only applies to domestic sales where the platform is regarded as the company that sold the goods. The platform's domestic sales of own goods, e.g. goods stocked in Denmark and sold to a private consumer in Denmark, must be stated in the ordinary Danish VAT accounts and not in the EU scheme.

If the company is not established in the EU and sells goods via distance selling to private consumers in the EU, an intermediary in the EU must be used to register the company in the Import Scheme. The intermediary must be registered in the EU.

In such cases, the Danish company/EU company that represents your company must be registered with the Import Scheme as an intermediary.

Need advice?

If you have questions about the new VAT rules for e-commerce and what they mean for your company, you are welcome to contact us on +45 70 232 232 or through the contact form below.