sign up for webinar on the new holiday act

We are already receiving inquiries from companies seeking advice on the new Holiday Act and how it will affect the processes in their business. In this article we have compiled information on the new Holiday Act that will be most important initially, in order to give a clear overview.

Why are we getting a new Holiday Act?

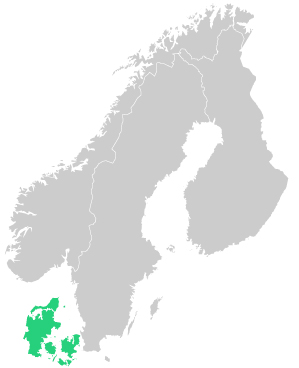

In 2014, the European Commission found that Danish holiday law was in breach of the EU’s Working Time Directive. The Directive states that employees are entitled to four weeks of paid holiday a year. Current Danish holiday law does not confer the right to four weeks of holiday.

The new Holiday Act is based on the recommendations delivered by a committee to the government in August 2017.

What is actually changing?

Compared to our existing Holiday Act, which is about 80 years old, the new Holiday Act will change many things. These changes can be loosely summarised in the following points:

1. Everyone gets paid holiday

Under the current Act, you must have worked for a year to receive paid holiday. This has a particular impact on new graduates, the long-term unemployed and the chronically ill. In practical terms, it means that you might have to wait for up to 16 months after accruing holiday before you can use it. Under the new Holiday Act, everyone will be eligible for paid holiday from their first day. There will continue to be two kinds of holiday pay: paid leave with a holiday bonus and holiday with a holiday allowance

2. New holiday year

Under the new Holiday Act, holiday will be accrued from 1st September to 31st August (12 months) and can be used between 1st September and 31st December (16 months). The reason that the holiday period is four months longer than the accrual period is to allow greater flexibility in relation to when holidays can be used.

3. Concurrent holiday

This new term means that you accrue and can use your holiday at the same time over a 12-month period. The employee can therefore use their holiday the month after it has been accrued. Employees will accrue 2.08 days of holiday every month, which can be used whenever they want. It also means that the delay we have become accustomed to will disappear (accruing holiday in the calendar year but only being able to use it from 1st May the following year). Employees will also be able to use their holiday over an additional four months, so there are 16 months in which it can be used (the holiday period).

Transition scheme

In order to ensure the smoothest possible transition to the new Holiday Act, a transition scheme has been introduced. When the new Holiday Act comes into force, employees will already have accrued a number of days of holiday that, due to the previous Act, will not yet have been used. On 20th September 2020, the employee will begin accruing new holiday in addition to this "old" accrued holiday, and these can be used concurrently. This means that employees will be eligible for up to ten weeks of paid holiday in the first year, since they will have accrued holiday under both the old and new schemes.

The economy and employers’ liquidity would be severely challenged if employees were to take such a large amount of holiday in one year.

Therefore, a transition scheme has been introduced to ensure that employees can still only take up to five weeks of paid holiday in the transition year, while also retaining the right to all their accrued holiday. The transition scheme will come into force on 1st January 2019.

The transition scheme entails the following:

- Holiday accrued from 1st January 2019 to 31st August 2019 (16.7 days of paid holiday) may be used between 1st May 2020 and 31th August 2020.

- Holiday accrued from 1st September 2019 to 31st August 2020 (25 days of holiday) will be frozen in a new fund under Lønmodtagernes Dyrtidsfond. The fund will be called the Employees’ Fund for Receivable Holiday Pay, and will manage employees' frozen holiday.

- The frozen holiday cannot be used or paid out until the employee leaves the labour market. In terms of the current scheme, this means that employers will pay the last year of accrued holiday when the employee retires.

The transition scheme ensures that the employee can take up to five weeks of paid holiday during the transition year, and that employers avoid paying for up to ten weeks of holiday in one year.

read more about how azets can assist you

The new Holiday Act means new challenges for you

The new Holiday Act will require considerable readjustments, and I would recommend that you start thinking about it now. New legislation always brings with it new administrative tasks, and the new Holiday Act is no exception. New tasks and processes must be thought through and incorporated. I have listed some of the most important ones below.

- You will need to update your employment contracts and staff policies so that they are consistent with the new Holiday Act.

- When holiday is accrued, accumulated and used concurrently, you will need to do holiday accounts for each employee on a monthly basis. How much has been accrued, used, etc.

- Your payroll and HR systems will need to be adapted so you can continually keep track of your employees’ holiday usage.

- No later than 31 December 2020 you must report to the fund how much frozen holiday pay each employee has.

- The fund will notify you on an annual basis of what the owed holiday pay should be indexed with (only relevant if you choose to keep the frozen holiday pay in the company and handle the administration your self)

When one of your employees leaves the labour market, you will be notified by the fund. You will be required to settle the employee's frozen and indexed holiday pay, and the fund will then settle with the employee and the tax authorities.

How is your liquidity?

If you want to avoid the administrative tasks associated with frozen holiday pay, you can choose to pay the owed holiday pay to the new fund. This means you don’t have to report, index or carry out additional payroll when an employee retires.

Before deciding to do this, you should make a thorough assessment of your liquidity. Such a payment will have a major effect on liquidity, and not all companies have sufficient funds for it to be a sensible decision.

Do you need assistance?

If you are an employer and need advice relating to holiday legislation or other employee/HR-related matters, please feel free to contact us. Read more